A single crash can expose how little protection “state minimums” provide. This guide explains Florida’s required coverages and the optional coverages that actually protect you. It then shows the consequences if you are injured by a driver with no or low insurance, and if you cause a crash without adequate limits. Finally, it compares common policies to realistic medical bills so you can decide what to buy before a loss.

Florida’s required coverages (what you must carry to register a vehicle)

Personal Injury Protection (PIP)

At least $10,000. PIP generally pays eighty percent of reasonable medical expenses and sixty percent of lost wages up to the limit, subject to any deductible, the fourteen-day treatment requirement, and EMC rules. Authority: Insurance Requirements and § 627.736, Fla. Stat.

Property Damage Liability (PDL)

At least $10,000 to pay for damage you cause to others’ property. Authority: Insurance Requirements.

Bodily Injury Liability (BI)

Not required for most Florida drivers, which is why UM/UIM is critical. Authority: Insurance Requirements.

SR-22 and FR-44 proof filings

SR-22 may be required after certain suspensions or at-fault crashes. FR-44 follows a DUI conviction and requires higher liability limits for a defined period, commonly 100/300/50. Authority: Insurance Requirements and What Is an FR-44 Form?.

What each coverage actually does in practice

PIP in real claims

PIP pays first but stops at the policy limit. The EMC requirement and fourteen-day rule control whether the full $10,000 is available. Authority: § 627.736, Fla. Stat. For deeper background, see Florida No-Fault (PIP) Insurance: Complete Client Guide for Daytona Beach, DeLand, and Sanford and Florida PIP Setoffs and Penalties: What Accident Victims Need to Know.

Medical Payments (MedPay)

MedPay can cover co-pays and deductibles on top of PIP, reducing early out-of-pocket exposure. Coordination clauses vary by carrier.

Property Damage Liability (PDL)

PDL addresses repairs, total loss, and some related losses for the other driver. Expect disputes over aftermarket parts, betterment, and diminished value. See Vehicle Property Damage in Central Florida: Repairs, Loss of Use, and Diminished Value.

Bodily Injury Liability (BI)

When present, BI funds settlements or judgments for injuries you cause and triggers a defense. BI is not mandatory for most drivers, which increases the importance of UM/UIM.

Uninsured/Underinsured Motorist (UM/UIM)

UM/UIM protects you when the at-fault driver has no BI or too little BI. Florida law addresses stacking, written rejections, and settlement sequencing. Authority: § 627.727, Fla. Stat.

Tort threshold reminder

Non-economic damages in motor-vehicle cases generally require a permanent-injury threshold. Authority: § 627.737, Fla. Stat. For how juries see medical bills and setoffs, see What Florida Juries Can See About Your Medical Bills in 2025.

Florida’s uninsured and underinsured problem

Credible estimates place uninsured motorists nationally around the mid-teens, with Florida consistently on the higher end. Summary source: Facts + Statistics: Uninsured motorists. Local takeaway: in Volusia, Flagler, Orange, and Seminole counties, the practical risk is that the person who hits you may have no BI or minimal BI. Your UM/UIM selection becomes decisive.

If you are injured and the at-fault driver lacks adequate insurance

- Medical bills and PIP limits. PIP pays eighty percent of reasonable medical expenses up to $10,000, then stops. The unpaid twenty percent and any amounts above the limit remain your responsibility unless BI or UM/UIM responds. Authority: § 627.736.

- Lost wages. PIP pays sixty percent of lost wages up to the same limit. The rest is a personal loss unless BI or UM responds.

- No or low BI. Without BI, there may be no source of recovery for pain and suffering unless you carry UM/UIM and meet the threshold in § 627.737. Authority: § 627.737.

- UM/UIM is the safety net. Stacking increases available limits across vehicles in your household, subject to your policy and selection forms. Authority: § 627.727.

- Health-plan liens and subrogation. Medicare, Medicaid, and ERISA plans often assert reimbursement claims; careful handling protects your net recovery. See What Florida Juries Can See About Your Medical Bills in 2025.

Practical result: without UM/UIM, clients often complete treatment with only PIP applied, significant balances outstanding, and no path to non-economic damages even in clear-liability crashes.

If you cause a crash and you lack adequate insurance

- Personal liability. Without meaningful BI and ideally an umbrella, your personal assets and future wages are exposed up to any judgment.

- Punitive damages and exclusions. Auto policies typically exclude punitive damages and intentional acts. A DUI often leads to FR-44 requirements after conviction, with higher mandated liability limits for a defined period. Authority: Insurance Requirements and What Is an FR-44 Form?.

- Property damage shortfalls. Low PDL limits risk out-of-pocket payments for repairs, total loss, diminished value, rental loss, and other consequential damages. See Recovering Diminished Value After an Automobile Accident in Central Florida.

- License and registration consequences. Failing to maintain proof of financial responsibility or to satisfy certain judgments can trigger suspensions until compliance.

Personal umbrella policies (what they do and what they do not)

What an umbrella is?

A personal umbrella is excess liability coverage that sits on top of your auto and homeowners policies. It typically adds $1,000,000 or more of liability protection once your underlying BI and PDL limits are exhausted.

What it usually covers and excludes:

It covers defense and indemnity for covered negligent acts after underlying limits are used up. It does not replace underlying coverage and requires you to maintain minimum BI and PDL limits, often 250/500 or 300/300 and $100,000 PDL. Common exclusions include intentional acts, punitive damages, business use, and vehicles not insured on the auto policy.

The UM/UIM issue

An umbrella does not automatically extend UM/UIM. Some carriers offer a UM endorsement to the umbrella. Many do not. If the umbrella has no UM endorsement, it protects you when you cause the crash but does nothing when you are injured by an uninsured or underinsured driver. If available, a UM umbrella endorsement typically requires your auto UM to match your BI and may not allow stacking.

Households and vehicles

Umbrellas can exclude certain motorized vehicles such as golf carts, ATVs, and watercraft unless scheduled. Household and resident-relative definitions matter. Confirm who is an insured and how vehicles titled to family members are treated.

Short numbers example

- Underlying auto: BI 100/300, PDL 100; UM 100/300 stacked on two vehicles.

- Umbrella: $1,000,000 liability only, no UM endorsement.

- Serious injury claim against you: BI pays up to 100, then the umbrella can contribute up to $1,000,000.

- Serious injury to you by an uninsured driver: your stacked UM pays up to 200. The umbrella contributes zero unless it has a UM endorsement.

Result: an umbrella without UM helps when you are at fault, not when you are the victim. To protect both directions, pair a liability umbrella with either a UM umbrella endorsement or higher stacked auto UM limits.

Stacking vs. non-stacking UM (simple numbers)

Two-vehicle household example: non-stacked 50/100 UM yields $50,000 per-person UM. Stacked 50/100 UM on two vehicles yields $100,000 per-person UM. See the visual below. Authority: § 627.727.

Chart: Available UM Limits: Non-Stacked vs. Stacked

Coverage vs. real bills: three scenarios

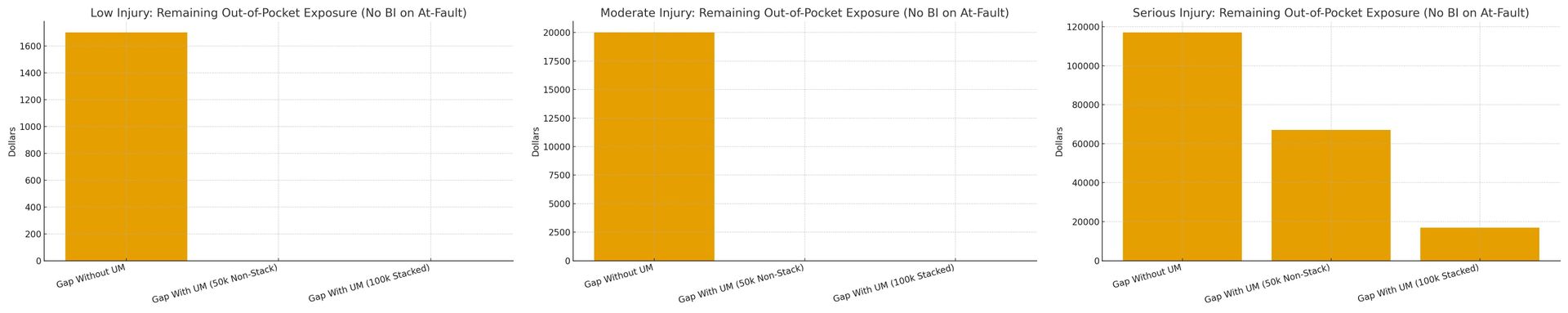

We model low, moderate, and serious injuries using conservative, illustrative numbers. PIP pays first, then BI if available, then UM/UIM. The chart below show remaining out-of-pocket exposure in three realities: no UM, non-stacked UM, and stacked UM.

For how Florida law treats medical bills and setoffs, see What Florida Juries Can See About Your Medical Bills in 2025 and Florida PIP Setoffs and Penalties: What Accident Victims Need to Know.

Criminal conduct and coverage

- DUI. Liability coverage may still defend and indemnify negligence claims, but punitive damages are typically excluded. A DUI conviction generally triggers FR-44 proof with higher limits for a defined period. Authority: Insurance Requirements and What Is an FR-44 Form?

- Intentional acts. Generally excluded under liability coverage. UM for your own policy may still apply when you are the innocent insured struck by another, depending on policy language and facts.

What is an SR-22?

An SR-22 is a certificate of financial responsibility that your insurer files with the Florida Department of Highway Safety and Motor Vehicles to prove that you carry at least the state-required liability insurance. It is not insurance by itself.

- When it is required. Usually after certain license suspensions, unsatisfied judgments arising from a crash, or driving without insurance.

- What it proves. That you maintain at least the minimum required liability coverage for a set period (often three years).

- What happens if it lapses. Your insurer must notify the state. Your license and registration can be suspended again until you show current proof and pay reinstatement fees.

- SR-22 vs. FR-44. SR-22 is the standard proof filing. FR-44 is a different filing required after a DUI conviction and it carries higher liability limits than an SR-22.

- Where to verify details. See Insurance Requirements.

Settlement sequencing to protect UM

Before releasing the BI carrier, preserve UM rights. Florida law provides a consent-to-settle framework and a thirty-day pay-to-keep-subrogation mechanism. Authority: § 627.727(6), Fla. Stat.

Checklist to avoid impairing UM:

- Notify UM of the BI offer and request consent.

- Follow the statutory steps if UM declines consent but elects to preserve subrogation.

- Keep copies of all forms, releases, and authorizations.

Buyer’s guide and renewal checklist

- BI. Aim for at least 100/300, then match to your assets and risk.

- UM/UIM. Match your BI. Select stacking if you have multiple vehicles.

- MedPay. Consider $5,000 to $10,000 to cover PIP co-pays and deductibles.

- PDL. At least $50,000 given modern repair costs and diminished value risk.

- Rental and towing. Add if you rely on your vehicle for work or school.

- Umbrella. Add $1,000,000 or more and confirm the underlying limit requirements on auto BI and PDL are met at all times.

- UM umbrella endorsement. Ask your carrier if a UM/UIM endorsement to the umbrella is offered. If yes, add it. If no, increase your auto stacked UM limits.

- Schedule vehicles. If you own golf carts, ATVs, watercraft, or motorcycles, confirm that they are insured and recognized by the umbrella.

Local notes and related reading

Vehicle Property Damage in Central Florida: Repairs, Loss of Use, and Diminished Value

FAQ

Do I need BI if it is not mandatory?

Yes. Without BI and an umbrella, you risk personal exposure if you cause injuries.

Should my UM match my BI?

Yes. Match or exceed it, and select stacking if you own multiple vehicles. Authority: § 627.727.

Can I release BI and still pursue UM?

Yes, but follow § 627.727(6) precisely to preserve UM rights.

What is FR-44 after a DUI?

A proof filing that requires higher liability limits for a period after conviction. Authority: Insurance Requirements and What Is an FR-44 Form?

Your policy is a contract that either shields you or leaves you exposed when a real crash happens. Florida’s minimums focus on PIP and property damage, not on protecting your body, wages, or future. The practical fixes are straightforward: carry meaningful BI, match it with UM/UIM, select stacking if you have more than one vehicle, consider MedPay, and use an umbrella for seven-figure third-party protection. If you need help, we will review your declarations pages, UM selection or rejection forms, and any settlement offers so you do not compromise your rights. Call 866-466-5925 for a free, same-day review.